When we say entrepreneurship it is Silicon Valley. But what if we move our sights over to Asia? According to Startup Compass, Singapore has Asia’s best start-up ecosystem in terms of the start-up’s throughput. Singapore’s well-made start-up ecosystem is said to be rooted in and backed by the country’s fertile financial infrastructure. Also the country’s viewed as the gateway to the Southeast Asian market. As a result, DEMO has made its first Asian debut in Singapore in 2011.

However, now is perhaps time to look at Korea. The nation has been traditionally called the Land of Calm but when it comes to high-tech and innovative products and businesses (and of course, the intoxicating Soju-drinking night life) it’s not at all surprising that the nation easily deserves another name – easily, the Land of “Oh, so hot!” And the fever radiates to the nation’s start-up scene.

Backed up by the world-best IT infrastructure, in terms of ICT level, Korea’s presence in the high-tech industries has been constantly escalating, and it led to a very high interests in technology from the nation’s general public. In addition to that, since the government of Korea has started to view start-ups as a means to relieve the unemployment issue of its youth under the age of 29, whose unemployment rate is about three times the overall, the government has launched a very aggressive start-up supporting initiatives – including, among others, extensive government-backed seed loans and a massive government-driven Korea Venture Fund (“KVF”, FoF) in 2005 whose par value well exceeded USD 1.5 billion in order to encourage entrepreneurial activities within the nation.

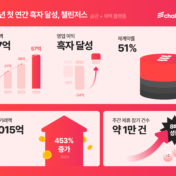

Such initiatives from the government certainly worked as a catalyst to drive Korea’s venture capitals to more actively source deals and invest in start-ups. Securing financial resources from the government-initiated KVF, Korea’s venture capitals are now more actively source deals in start-up companies and as a result, the number of fresh investments in start-up companies (less than one year) has nicely increased to double from 60 in 2006 to 116 in 2011. Also the gross amount of fresh investment in the start-up companies has more than doubled, from KRW 71 billion (approx. USD 65 million) in 2006 to KRW 175 billion (approx. USD 160 million) in 2011. In series of these events that enriched the nation’s soil for start-up companies is increasing attractiveness of start-up companies as alternative investments for the uncertain traditional capital market and attracted more individual investors as angel investors. Korea’s SMBA (Small and Midsized Business Association) initiated and KVCA (Korean Venture Capital Association) run Angel Investment Support Center (“AISC”), an official hub for angel investors. AISC registers individual investors and angel clubs and according to AISC, as of June, 2012, there are more than 14,000 individual investors and 41 angel clubs registered. AISC is also offering angel investment market where entrepreneurs and venture companies can upload their business ideas and source possible investors, and a angel-matching fund for registered angel clubs in their investment activities in which the center matches the amount of the clubs’ investment.

Despite these continuously reinforcing supporting waves for venture businesses, it is true that there are still concerns raised about the weak exit models for investors: say, about three fourths of exit are through IPOs however less than 2% of the entire portfolio companies of venture capitals successfully land in the KOSDAQ market (Korea’s equivalent of NASDAQ) and M&As are a relatively very rare option for, especially, start-up companies.

“I don’t see it much as a threat to venture capital investments,” says James Kwon, a senior manager at Qualcomm Ventures. “I only see it as a natural outcome of natural competitions. I get to view, say, 100 business plans from entrepreneurs but only end up investing in about two companies. That’s about 2%. Considering that percentage, the IPO success rate doesn’t sound much like a harsh situation. Nor do I think it’s a ‘Korea only’ situation. Regardless of the success rate is for IPO, we’ll keep investing in good companies. However, having a more solid M&A market for start-up companies, say, like in U.S. is certainly going to help hedge risks for investors.”, adds he.

Certainly Mr. Kwon doesn’t seem too much worried about the very little IPO windows. Perhaps is it because he’s with a corporate venture capital? Despite his confident remarks, it is also true that many of venture capitalists on the other hands points out the high risks associated with the weak exit models. The government is aware of the issue and attempts to ease out the worries by offering some other programs to encourage M&As for start-ups, including an M&A support program for certified business – where KIBO (a technology-certifying arm of Korea’s SMBA) directly get involved in M&A deals with CB and/or BW investments, and KRW 30 billion (approx. USD 27 million) worth M&A matching funds which is being constructed this year.

One thing Korea used to lack was start-up accelerators and incubators like Plug and Play Tech Center in the Valley. However, the government’s efforts are relentless. This year, SMBA has designated two start-up acceleration centers which will not only incubate start-ups but also extensively support them to successfully grow with seed funding, which SMBA will match, and mentoring and what not. Also experienced entrepreneurs are coming back to the game to help the new. Primer is one and is incubating handful competitive start-up companies. To make it better, such national scale efforts are finally practically increasing the attractiveness of Korea’s start-up scene so Team Europe, a Germany-based start-up incubator, has launched its arm in Seoul this week as the first foreign start-up incubator.

For its 20-year-or-so history of venture business, as you’ve just seen – from its infrastructure to the financial system, Korea is obviously setting up a very nice and attractive stage where the artists can shine if only they have what it takes to be a star. So could and will Korea be the soul for Asia’s entrepreneurs? We still need one more thing to complete the picture and it’s the works of the artists on the stage. In the following article, we will take a deeper look at the hot-shot artists and what stories they’re writing and playing to become the next hero.