Viva Republica, the providers of P2P money transfer service ‘Toss’, raised KRW 26.5 billion (about $23 million) on April 11th from a consortium consist of the leading domestic venture capital from KTB and Sillcon valley based firms from Goodwater capital and Altos ventures. The capital raised from this round will enable the company to strengthen Toss’ market dominance and expand its lineup of Fintech services.

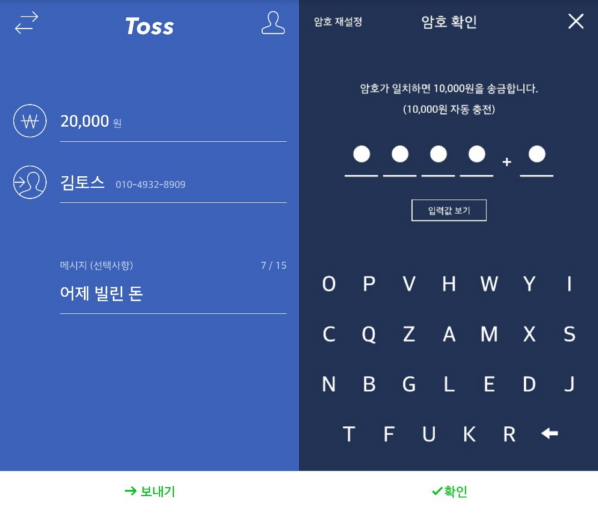

Toss, which launched on February of last year, allows users to send and receive money in a matter of seconds. It condensed the complex authentication process into three simple steps; with Toss, users can send money just by filling in the recipient’s bank account, transfer amount, and password. The service has become widely received by the millennium generation as it is continually improving its user-friendly features such as fingerprint recognition and alerting users of to suspicious bank accounts.

In January Toss reached KRW 100 billion in accumulated transactions, but has since continued to rapidly grow as last month’s transaction amount alone totaled KRW 100 billion. As of April 2016, Toss reached a total accumulated transaction amount of KRW 300 billion, surpassing all competitors in the P2P transfer space.

And users use Toss aggresively. Average transaction count in Toss is about 7.2 per month, which is more than 3x compared to average transaction count through banking app in general (2.2 per month based on last year statistics from BOK).

Toss is downloaded 2 million times for now and maintaining rank #1 in Finance category, Appstore.

“I’m impressed with how quickly Toss was able to gain market dominance and loyalty from its users”, said Han Kim from Altos ventures. Also said, “I have high expectations that Toss is going to lead the Fintech revolution as a premier financial platform.”

“Lots of fintech services using mobile channel is fundamentaly different from legacy financial product from banking retail in terms of accessibility, simplicity. we aim to continue strengthening our partnerships with 16 banks we already have relationship with by working together to provide genuine financial product for mobile channel”, said Seunggun Lee, Viva Republica CEO.